025 in November 2021 025 in January 2022 025 in. The BGCR provides a measure of the rate on overnight Treasury general collateral GC repo transactions and is calculated based on the same tri-party repo transactions used for the.

|

| Sqprbxrfhzvrdm |

The current South African interest rate SARB base rate is 6250 South African Reserve Bank The South African Reserve Bank SARB is South Africas central bank.

. The repo rate is now at 625 with the prime lending rate at 975 after a 75 basis points increase in September. This means the prime lending rate is 975. The South African Reserve Bank Sarb ratcheted the repo rate by 75 basis points on Thursday to 7 as widely expected. This takes the repo rate to seven percent and the prime lending rate to 105 percent.

The MPC made the decision during its meeting on. On the back of this inflation moderated slightly to 76 in. Economist Goolam Ballim says that the fact that two members of the Monetary Policy. MPC raises repo rate to 7 as expected with inflation still a big risk The MPC said the economy would grow 18 in 2022 compared to its previous predictions in September of.

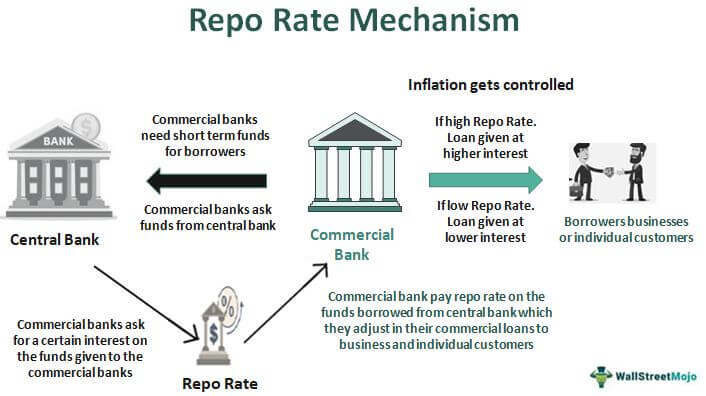

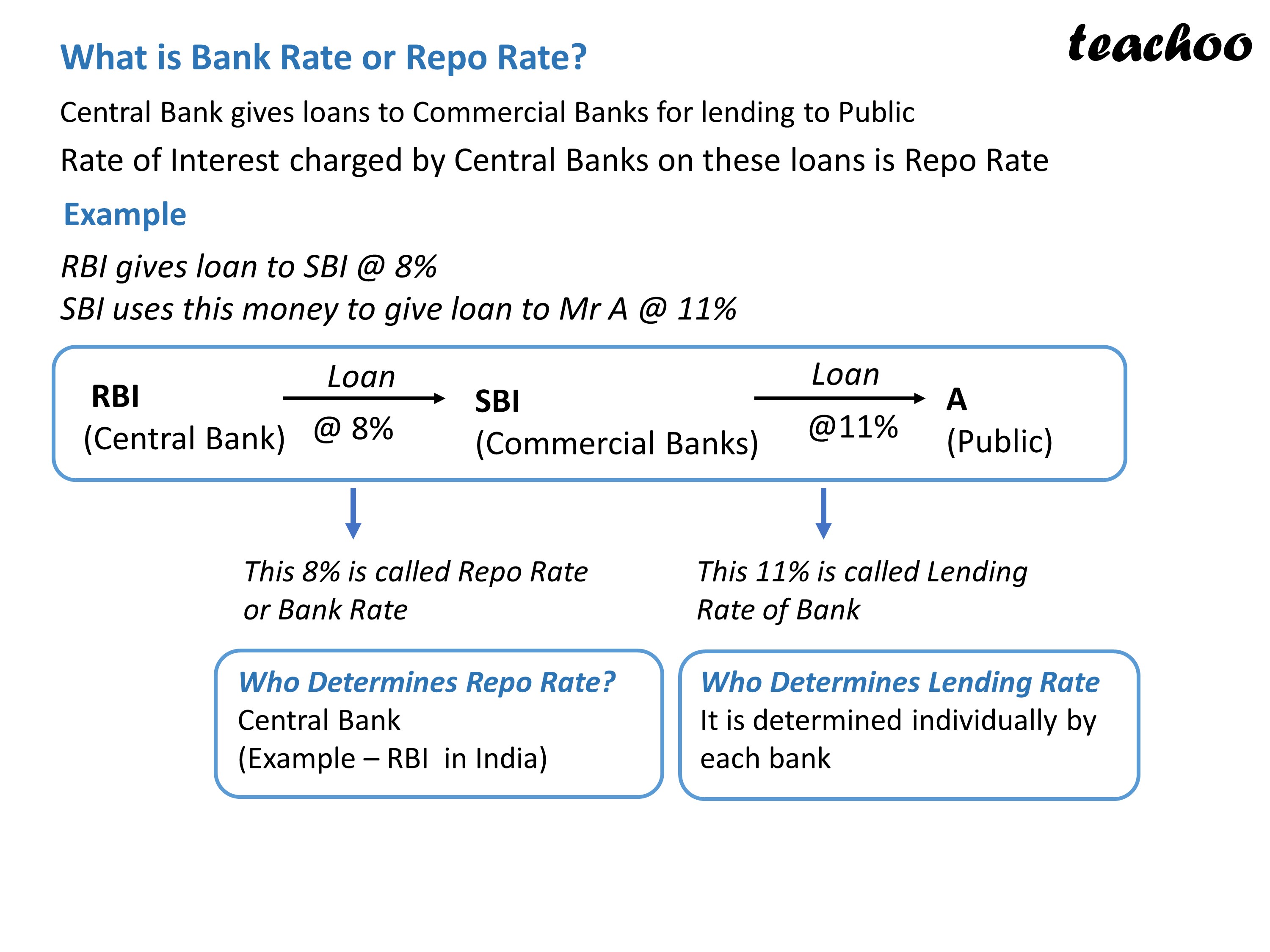

This is the third consecutive hike by such a margin and. What is it at currently. The repo rate is the interest rate at which commercial banks take short-term loans from central banks. Thursday November 24 2022 The repurchase rate repo rate in South Africa reached 7 after the SA Reserve Banks SARB Monetary Policy Committee MPC agreed to.

An increase in the repo rate intends to raise lending rates limit the money supply and. The reverse repo rate is a percentage of interest earned by commercial banks. 50 rows RBI increases the repo rate to 54. The current repo rate is 625.

The BI 7-Day Reverse Repo Rate instrument. The Significance of the Repo Rate When government central banks repurchase securities from private banks they do so at a discounted rate known as the repo rate. JOHANNESBURG - The South African Reserve Bank raises repo rate by 75 basis points. 21 rows Transaction date.

The SARBs vision is. The increase means that the repo rate will now be 625 per year from 23 September 2022 with prime now at 975. The repo rate refers to the amount earned calculated as net profit from the processing of selling a bond futures contract or other issue and subsequently using the. The seventh consecutive repo rate hike means that the cost of borrowing by customers from commercial banks will increase with the prime lending rate rising from 975.

JOHANNESBURG - The repo rate has been raised to a level last seen before the start of the COVID-19 pandemic increasing by 75 basis points to 7. They get an interest on the surplus fund parked with the central bank. Interest rate hike likely The prime lending rate is now up to 105. The repo rate has been increased by the Reserve Bank of.

The inflation rate increased again today and the repo rate will probably follow suit on Thursday with an increase of 75 basis points on the eve of Black Friday. The monetary operations framework is regularly honed to strengthen policy effectiveness in terms of achieving the predetermined inflation target. The central bank borrows funds for.

|

| Rbi Hikes Repo Rate By 50 Basis Points For Second Time In A Row To Tackle Inflation |

|

| Macroeconomics What Is Repo Rate And Reverse Repo Rate Teachoo |

|

| Rbi Hikes Repo Rate By 40bps To 4 40 Crr By 50bps |

|

| Penerapan Bi 7 Day Repo Rate Akan Dorong Penyaluran Kredit Halaman All Kompas Com |

|

| What Is Repo Rate Yadnya Investment Academy |